2026 Cosmetic Trends - Skincare In Times Of Turbulence, Written By a Gen-Z

Aiden van WykDo you ever walk into a skincare aisle, look at the shelves and wonder:

Why?

Why are we spending R800 on a small jar of cream? In a sinking economy, political instability - on a national and international scale - and with the future so uncertain.

Who is doing this?

And why... Why do I feel tempted to do it myself too? Why does this tub feel like... the last piece of care I have left?

And therein lies the beating heart of cosmetics globally.

We are learning in real time that cosmetics are not merely products of performance - they increasingly reflect our values, and how we show up for others.

Why Is The Cosmetic Industry Growing In 2026?

While skincare may be an activity - caring for your skin truly means something. The obsessing over what routine is best, the nuanced debates around the ethics of organic vs certificates vs synthetic but more ethical than natural options.

Underneath all of this lies our vulnerable response to uncertainty:

- Routine reminds us that cause and effect does still exist, and that our actions can still mean something in the world. This can be profoundly stabilising when the future doesn't feel that way.

- Skin is the great equalizer - everyone has it, regardless of circumstance. Skincare therefore becomes a form of private luxury that many people can still justify, where spending a little more is framed as maintaining self-respect rather than indulging.

- Skincare is one of the last remaining bastions of non-digital moments people protect. Many of us live online now, where the loudest outburst is rewarded best, whereas skincare can offer a much sought out and needed grounding in the 'real' that can stimulates our often neglected senses; such as touch.

- What is the quiet defiance of doing skincare in uncertain times? Hope - a small, deliberate investment in future wellbeing, rooted in the belief that care still matters.

Why Is This Relevant To You?

This is the heart of skincare all over the world. Life is becoming increasingly tough all over, and despite this (or maybe even because of it) the cosmetic industry continues to grow:

- Japan & Korea: facing long-term demographic decline, overwork, and shrinking futures.

Japan's cosmetic industry grew by approximately 48% over the past eight years (*1). South Korea's cosmetics exports alone increased by more than 20% between 2023 and 2024 (*2), signalling strong global demand despite domestic strain. - Europe: spent the past few years navigating economic stagnation, rising living costs, and political uncertainty.

Even so, the region's beauty market grew from $111.72 billion in 2021 to $126.74 billion by 2025, with a projected 24% increase between 2025 and 2033 (*3). - US: amid increasing political polarisation, economic hardship, constant media churn, and a culture shaped by constant pressure to improve - and the fatigue that follows.

During this time, the beauty and personal care sector has continued to grow. Market value rose from $136.7 billion in 2021 to approximately $155.3 billion in 2025, with forecasts indicating growth to around $191 billion by 2033 - a 23% increase (*3). - South Africa: navigating persistently high unemployment, rising food and petrol costs, and ongoing political and infrastructural uncertainty.

South Africa's beauty and personal care market is valued at approximately $3.97 billion in 2025 and is projected to reach around $5.29 billion by 2030, representing roughly 33% growth over five years (*4).

International conditions differ, but the outcome is the same.

Cosmetics emerge as a quiet response to uncertainty - offering routine, control, and moments of care when much else feels unstable. Rather than shrinking in difficult periods, demand strengthens, reframing cosmetics as a constant rather than an extra.

For brands, this shifts the focus slightly.

No longer can they rely on price, logos, influencer shout-outs, or even ingredients alone to draw consumer interest. They instead need to focus more on brand values. On who they are. On what they stand for.

And ultimately, on whether customers will be rewarded (and not disappointed) for placing their trust in the brand.

Trends Moving Over From 2025 to 2026

Trends don't ever really disappear - instead they evolve.

And in our fast-moving cultural conditions, aesthetics often don't replace each other; they splinter.

The Clean Girl And Her Sisters

If you've been online for any amount of time, you're probably at least vaguely aware of the "clean girl" concept, who graciously arose in response to excess. Not long before her, beauty culture was mostly maximalist: heavy contour, bold colours, and loud self-expression. Minimalism was relief.

But as culture developed, the clean girl's promise of "minimalist, effortless" beauty quickly became extreme discipline, expensive routines, and hidden labour.

As a response to this great contradiction, the aesthetic didn't disappear. It fractured.

- The Messy Girl: The messy girl rejects the illusion of effortlessness. Embodied, the messy girl is permission for visible effort and visible imperfection in a culture that in pursuit of flawlessness, left their humanity behind.

How To Identify: smudged liner, faded lips, skin that looks touched rather than perfected. Hair and styling that appear unpolished, even accidental. - The Mob Wife: The Mob Wife reads the clean girl's self-restraint as performative rather than simple. As a response, she flaunts her consumption, reclaiming excess as confidence, and refusing to apologise for appetite.

How To Identify: heavy eyeliner, big hair, faux fur, dark colours, visible luxury. - The Tired Girl: This girl is tired. She sees the productivity, investigation and relentless optimisation of the clean girl as exhausting. As a response, she makes burnout visible, framing fatigue as a shared experience rather than failure.

How To Identify: smoky, slightly faded eye makeup, softer skin tones, a look that suggests lack of sleep - but still pretty :) - The Vamp Revolution: A rising tide in aesthetics; the Vamp has been a long time coming. The Vamp rejects softness and relatability as default. What it does for the wearer is offer control, intrigue and authority. It blends the rebellion of the messy girl with the status of the clean girl, creating an aesthetic of deliberate intimidation and allure.

How To Identify: deep tones, sharp lines, smudged yet refined eyeliner.

Tastes shift quickly. Identities burn white hot, then become repulsive. Be wary of basing your brand on a specific aesthetic, rather find the fundamental human motivation underneath, and grow with the visual language it adopts.

Skincare As Grooming - Male Skincare

Skincare for men is an ever growing industry, globally and locally.

The global men's skincare market is currently valued at roughly $17-20 billion and is projected to nearly double over the next decade, reflecting how routine skincare has moved firmly into the mainstream (*5).

While many young men have grown disillusioned with the more extreme ends of 'looksmaxxing' culture, the value of basic skincare has stuck. It's increasingly treated like grooming: practical, functional, and tied to confidence.

What resonates most seem to be products that acknowledge specific male cosmetic concerns:

- Thicker Skin

- Higher Collagen Density

- Earlier Hair Thinning and Patchy Beards

- Greater Exposure to Environmental Stress

Simplicity is key here. The products that do well are easy to use, clearly explained, have a clear effect, and are framed as maintenance rather than transformation.

Innovation VS Ancestry: The Modern Selfcare Split

While novel technology blazes ahead, the craving for products that we can truly trust has only grown stronger - especially as the unintended consequences of new technologies become more visible.

There is no better duo to exemplify this topic than the cultural rise of Ozempic and Tallow.

Ozempic

Ozempic absolutely blew up almost overnight - when we noticed swaths of celebrities lose weight at suspicious rates.

But as the weight dropped, so did a new concept to the zeitgeist: Ozempic face and Ozempic butt.

Rapid weight loss often leads to visible volume loss - hollowed cheeks, deeper wrinkles, stretched skin. In 2024, facial plastic surgeons reported roughly a 50% increase in volume-restoration procedures, with many patients citing rapid weight loss from GLP-1 medications as the primary driver (*6). The knock-on effect for the beauty industry has been predictable: increased demand for plumping actives, firming formulations, intensive barrier support, and even hair, brow, and lash products addressing shedding linked to metabolic stress.

Tallow

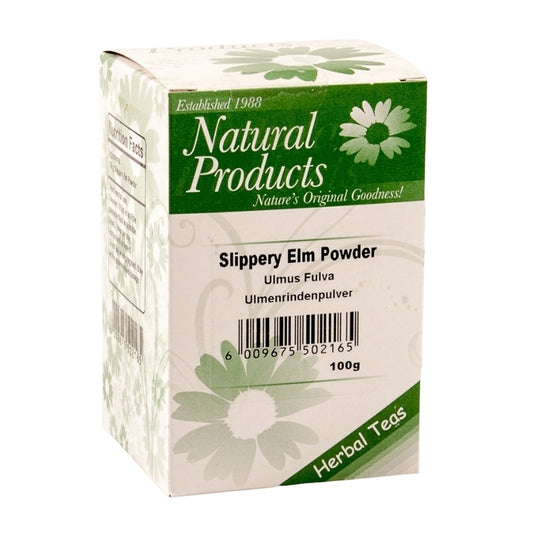

As a response, people are gravitating toward ingredients that feel "natural", ancestral, and already proven by tradition. Tallow, bone broth, botanicals and other traditional staples have re-entered the conversation not because they are new, but because they are old. Their appeal lies in familiarity and perceived safety - a sense that these materials have already lived through generations of human use without surprise consequences.

At its core, it's a tension between the new unknown and the old reliable traditions.

When new technologies leave problems in their wake, consumers look for anchors. In 2026, this tension will continue to shape skincare choices, with brands expected to justify not just how something works, but how long and consistently it has been trusted to work.

From Financial Strategy to Sceptical Consumerism

There is no doubt that, due to scientific research and growing global accessibility to once regionally exclusive ingredients, skincare is more potent and effective than it has ever been. In many cases, skincare genuinely is worth the investment.

But effectiveness competes with reputation.

Consumers today are not just budget-conscious - they are notably more discerning. Increasingly, customers shop for specific ingredient names, trusted influencer recommendations, and products from AI-generated routines. Salicylic acid. Glycolic acid. Niacinamide. Ceramides.

They know what they're looking for, even if they don't know why.

What we're seeing is a crack in authority.

Consumers no longer trust big name brands, all influencers, or even industry experts by default. Instead, they bounce between evidence, routines, and their gut.

The problem is, they know enough to be cautious, but not always enough to evaluate nuance. And hey, that is tough to do - even for professionals.

The opportunity in 2026 is not to overwhelm customers with technical language, but provide clarity: to explain ingredients honestly, contextualise risks, and guide decision-making.

Discerning consumerism isn't about distrusting everything. It's about wanting to trust something - and needing help deciding what deserves said trust.

Hair And Scalp Care

Haircare itself is not new. What is changing is how the scalp is understood.

Emerging research into the hair follicle microbiome is shifting scalp health away from surface-level treatment and towards something more systemic. The scalp is increasingly framed as an ecosystem - one that influences hair growth, inflammation, and common conditions like dandruff - rather than a problem area to be corrected in isolation. (*7)

This mirrors a broader move away from quick fixes and towards long-term balance. Much like facial skincare, scalp care is being reframed around maintenance, prevention, and future wellbeing, quietly asserting haircare's place within a more health-adjacent, systems-oriented approach to cosmetics.

We Hate Antiaging But Love Longevity?

The word "antiaging" has quietly become a red flag in selfcare.

Many consumers have seen at least one dermatologist explain that ageing isn't something you can reverse or stop - and once that idea lands, trust in any product claiming to do so tends to sink. Fast.

But the concern remains.

People still want firmer skin. They still want brightness, elasticity, and vitality. In practice, they are asking for almost everything the word anti-ageing was trying to communicate - just without the inflated promise or moral discomfort.

This is where longevity enters the picture.

Longevity reframes the goal from fighting time to supporting the body. It suggests holistic care rather than correction. Consumers are no longer looking for products that claim to "erase" age, but for formulas that help skin function well for longer - strengthening barrier health, supporting collagen, improving recovery and overall skin quality.

For 2026, longevity replaces resistance with support: consumers are drawn to products that work with the body, supporting its processes rather than positioning it as something to be corrected.

2026 - The Major Three Trends

Going into 2026, three major shifts stand out. They aren't niche trends - they fundamentally change how skincare is understood and evaluated.

Skincare is Health. Health is Skincare.

As the cosmetic market becomes more saturated, skincare increasingly competes not just with other beauty products, but with health, wellness and preventative care.

Skin and hair are emerging as some of the most accessible indicators of internal health - visible, measurable, and comparatively non-invasive. Hydration levels, inflammation, and healing speed increasingly act as outward signals of what's happening internally.

We already read these signs intuitively. Dry lips suggest dehydration. Slow-healing scars suggest ageing. As technology evolves, these will become more formalised - with skin and hair positioned as everyday biomarkers of overall wellbeing.

What this means for skincare producers is a fundamental reframing. A serum is no longer just cosmetic - it communicates your vitality and long-term resilience.

Beauty shifts all the more from indulgence to insurance - personalised, preventative, and increasingly scientific.

Skincare As A Verb - And What That Verb Became

Smell, feel and colour have traditionally been thought of as a "nice to haves" in cosmetics - and if your products stinks, feels weird, or start to concern due to noted itchiness or even burns - we were taught to bite the bullet. Beauty is pain.

That tolerance is disappearing.

Skincare competes less on promised outcomes and more on lived experience. While consumers are sceptical of miraculous claims - they do trust what they personally feel/see immediately and repeatedly. This fundamental part of their daily routine is being optimised for maximum self-care:

- Scent: does it calm, energise, or feel familiar enough to return to?

- Texture: application becomes ritual. The weight of a balm, the slip of a serum, the repetitive motion across the face - these moments anchor people back into their bodies.

- Colour: while easily dismissed as superficial, colour consistently shapes preference. We still respond to beauty, play and visual pleasure - even in functional categories.

Results are no longer differentiators; they are a base expectation.

Modern skincare is judged on its additional ability to regulate emotion, enhance living, and create private moments of care. Brands that build products around human experience - not only abstract future promises - may earn loyalty quickly.

When Digital Perfection Breaks Trust

The sentiment around hyper-polished technology is palpable: We have had our fill - and then seven helpings too much.

The moment something odd about a video appears - extra fingers, a cute dog is missing a leg, the video creator is talking but... without involving his throat? And apparently overcame the need to... you know... breathe?

There is a universal sigh in all of us, saying:

"I have been tricked. Again. And I caught it this time. But I probably didn't catch the last. Nor will I catch the next."

AI slop is the straw that broke the camel's back.

Now perfection starts to smell artificial, and artificiality poisons trust. Filters, CGI faces, AI marketing and chronically sanitised branding increasingly feels hollow - or worse, deceptive - in spaces meant to feel social and human.

This does not mean technology is being rejected outright. In fact, reliance on advanced tools will continue to grow. AI remains invaluable for research, optimisation, comparison and problem-solving - especially in areas we need like ethical sourcing, environmental impact and formulation analysis.

But there is a clear boundary emerging.

We welcome technology as a thinking tool, not as a human alternative.

When people buy, we don't buy with logic alone. We buy with emotion and identity. This is why long-form content is resurging - it allows consumers to understand who they are supporting, not just what they are purchasing.

Story builds trust and care. We support the stories we care about.

And the moment a brand's voice is identified as artificial, that trust is fractured.

What Stops Buyers In 2026?

Most consumers won't argue, complain, or even ask questions. They'll search quietly, feel uncertain, nervously smile at you, and simply move on.

Brands that address the concerns below clearly won't just convert customers; they'll earn loyalty.

Chemical awareness

As information becomes more accessible, so does fear - often without context. Consumers with no chemistry backgrounds are increasingly taught to avoid "chemicals" altogether, or to blacklist specific ingredients.

Often, this concern is justified. Public pressure around hormone disruptors, environmental harm, and ingredient ethics has led to meaningful improvements - palm oil certification like RSPO being a major example of how scrutiny can drive better practices.

This push has led to clearer labels and cleaner formulations, which is a win. But it has also increased testing requirements, certification costs and reformulation pressures - all of which raise prices and limit flexibility.

Brands and consumers are now walking a tightrope together: trying to do the right thing without reducing the efficacy or availability of skincare - all while competing in an increasingly price-sensitive market.

The Counterfeit Boom

One of the least discussed - but most damaging - forces in cosmetics is the rise of counterfeit products and online scams.

Counterfeits don't just undercut legitimate brands on price; they actively destroy trust for all cosmetics. These products often bypass basic safety standards, leading to adverse reactions or inconsistent results. When this happens, consumers rarely think "this was counterfeit". Instead, they conclude either that skincare doesn't work - or that legitimate brands are "overcharging for the same thing."

This erodes confidence across the board.

It also creates an uneven playing field.

- Authentic brands are forced to compete against cheaper, substandard imitations in an already saturated market.

- New brands on the market are no longer met with neutrality - the moment they arrive they are under scrutiny and suspicion.

In this environment, basic trust isn't assumed. It has to be earned, explained, and defended.

Price Sensitivity

Many consumers are willing to invest in skincare - but price still triggers hesitation.

For someone without firsthand experience of an effective routine, paying the equivalent of a week's shopping for a 50ml serum feels reckless. Especially when every product comes with the caveat: results may vary.

The fear isn't just wasting money - it's regret.

Consumers don't want to relive the moment they bought an expensive cleanser that performed no better than a basic one, then spent the rest of the month scraping by, frustrated. I've done it before, your face may be clean but your soul is heavy.

Price isn't only about affordability; it's about emotional safety after purchase.

Concerns Around Ingredient Sourcing

As brands compete on ethics, sourcing and certification, consumers learn what to look for - and what to distrust.

"Cruelty-free"

"Palm oil-free"

"Organic"

"BPA-free"

Even when consumers don't fully understand these terms, they recognise them as signals of safety and care. And when those signals are missing, assumptions are made.

If a product isn't organic, consumers want to know why.

If it uses palm oil, they want to know how that palm is sourced.

If it isn't COSMOS-certified, they want clarity on what standards are being followed.

Brands that fail to explain their choices risk being grouped with the worst actors in the industry - regardless of intent or quality. Transparency isn't a nice-to-have anymore; it's the minimum requirement.

The Underlying Truth

None of these concerns mean consumers are anti-skincare.

They mean consumers are increasingly careful.

In 2026, this caution reshapes how brands must communicate. Success no longer comes from being the loudest or the cheapest, but from answering questions before they are asked - calmly, clearly, and with heart.